Not just a transaction

Billing is a customer experience

Billing is an essential part of any organization—an instrumental feature in the functionality of the business. However, within subscription businesses it's also essential on a more holistic level, instrumental to building trusted relationships with customers, reselling partners and internal users. The combination of the mechanical billing function, combined with a great experience, has a significant impact on your brand, sales, operating costs, and business maturity and robustness.

All businesses require necessary features like payment tracking, integrated payment processing, accounts receivable and accounts payable. However, in subscription businesses the process is made more complex by the recurring nature of billing and the need for adaptability as customers scale their subscriptions up or down.

In this article, we look at the key features needed in the perfect subscription billing experience, as well as the processes that surround it, such as making a sale through self-service capabilities or direct sales channels, streamlining order and contract changes, and accounting requirements.

Billing isn’t just a financial function—it’s an essential part of creating a seamless customer experience and building trust.

Billing automation matters

Why is the subscription billing experience important?

Billing in a subscription business needs to be considered not merely as a mechanical function but as part of the ongoing customer journey. It's an important part of a subscription business, not only because it's the method of collecting revenue, but because it's instrumental for retaining customers over time.

The mechanics of a billing experience might be about software, keeping track of sales and payments, managing cash and preventing errors in the compilation of bills and invoices, but the seamlessness of that process has a direct impact on customer relationships, customer experience and helping to build trust and prevent churn.

The customers’ sense of satisfaction with the billing experience impacts their choice to retain the service, and in turn that influences whether they recommend you to other customers, as well as your ability to build your customer base. That cumulative growth is the essence of a growing, successful and sustainable subscription business.

Ask the right questions

Prerequisites for a frictionless billing experience

What should you look for in the perfect billing experience? It starts with asking the right questions.

Identify the following for the first instance

- Who needs to be billed?

- What subscriptions/products do they need to be billed for?

- How much should they be billed (pricing model)?

- When do they need to be billed (billing cycle)?

- How do you collect payments?

- How does the subscription data need to be reported for analytics and accounting?

- What happens if the customer upgrades, downgrades, or cancels the contract mid-term?

- How do you generate a credit memo?

- How and when do you notify customers and resellers?

- How much of the billing and finance workflow should be automated, and which process should stay manual?

- Which process should stay in the CRM, in the subscription platform, or in the ERP (enterprise resource planning)?

Your subscription engine should then provide the solution. It's best to look for a billing solution that already has these integrated features, and that can fit into your wider subscription engine. Lots of providers will simply say that you can custom build specific subscription requirements, but building your own billing system is complicated, costly, and invariably suffers from glitches that dilute or damage the customer experience. keylight is developed to be the best of all worlds, with the flexibility to adapt to what you need, integrate other systems when you want, and with an established infrastructure to provide an effective space in which to deliver everything your business requires.

Best-practice capabilities for an optimal billing experience

- Customizable billing logic

- Automated proration handling

- Usage-based billing

- Consolidated invoicing

- Advanced calendar billing

- Recurring and advanced invoices

- Dynamic account network with account hierarchy

- Manage payment failures with dunning workflows

- A rule-based, API-first approach that can respond to subscription contract changes quickly, easily, automatically and accurately.

- Pre-built integrations, custom fields and custom data formatters allow you to define information and map it to fields in external systems for seamless integrations.

- Automated journal entries for billing documents and payments, adjustment notes, foreign exchange losses and gains and more.

- Native report reconciliation and unified data flow across all areas of business.

- An established framework that allows you to integrate systems as you choose, but also use as many native services as you like.

Your subscription engine should also provide the following for customers to have a nurturing and comfortable billing experience:

Strong subscription management

Subscription management is the process of managing the customer's subscriptions and ensuring that the experience they have is a positive one. This is essential to any subscription business and its billing experience. Crucially, it's an ongoing, rather than static, process.

Management needs to adapt over the course of a user's lifecycle, taking into account any upgrades, subscription pauses and adjustments that reflect their changing wants and needs. Management also needs to incorporate price changes, discounts, trials and freemium experiments, all of which impact the billing experience.

Your system should be able to handle all those elements, both as the individual customer relationship develops and as the business itself scales up.

Recurring billing capabilities

The recurring nature of billing in subscription businesses is one of the key elements that sets it apart from other types of organization and billing engine. As pricing changes over time and you experiment with different pricing offers (perhaps with A/B testing), your billing system needs to be able to adapt accurately.

It's also important to remember that key point we mentioned at the start—billing is a mechanical function but is also highly connected to the other part of the business, making it integral to delivering a good experience.

As a result, billing capabilities have to be about more than just that primary role. They have to enable businesses to bill according to the relevant pricing model, whether you take a one-time, recurring, subscription, usage, volume-based, pre-paid, project, or flexible mixed approach.

It's also crucial to find a system that is built to evolve. Subscription business and customer needs change over time, both individually and collectively, so monetization models need to have the capacity to become more tailored over time. That’s why the billing capabilities of a business platform needs to be flexible and connected to the whole subscription experience.

Recurring payments

Distinct from the recurring billing capabilities, your system needs to be able to stay on top of recurring payments and ensure they're being collected. This means allowing for different payment methods, understanding that people and different regional markets have their own preferences. However, it also means making it simple and easy to update payment methods or to send reminders, for example if a customer's card is out of date.

How recurring payments are managed will depend significantly on whether you have a largely self-serve subscription business model or a solid sales rep-driven model. This will define whether customers have the freedom to manage their own payments or need to contact a sales rep for support.

Dunning management and smart retry features

Dunning management is an automated payment recovery mechanism, which activates if a payment fails—an event which might happen for example if a customer's listed credit card has expired over the course of their subscription. In that event, Dunning management will notify the customer electronically—usually by email, text or an in-platform notification. Smart retry features work in tandem with dunning management—if a payment fails, it attempts the payment again. For example, in keylight you can configure both the frequency and number of times the retry should happen. If you still don't receive payment, you can set up automated emails, document templates, or trigger service deprovisioning or workflows in another system to start the further dunning process.

Having the capacity to automate processes seamlessly between payment solutions and the subscription engine is essential for subscription businesses in order to stay on top of their finances, but also to help retain customer relationships. Subscription businesses need to see the successful collection of payment as their responsibility, making it as easy as possible for customers to update payment methods, and to collect payment without antagonizing or upsetting the customer and thereby losing the relationship.

Automated processes are essential for both customer relationships and sustainable business management, especially as your organization grows and you develop a high volume of transactions.

Accounting and taxes

A recurring billing system has to seamlessly sync with your accounting system, mapping everything including a chart of accounts as well as the type of accounts, e.g., currency exchange losses and gains, regional revenue, deferred revenue, add-on revenue, sales tax, and so forth, correctly. This depends entirely on how much of keylight you decide to use. For example, automated journal entry is a native functionality but you can use your ERP for general ledgers if you prefer with every preceding step handled in keylight.

Many subscription businesses operate across national and international borders, each with different tax rules and rates. For this reason, it's vital that your billing platform can automatically calculate tax and VAT based on the region you are selling into. The system has to be painstakingly accurate so you know you can trust the numbers that it produces and don't end up with issues with financial authorities or unexpected tax bills.

Reporting and analytics

Reporting and analytics are the backbone of subscription management and are essential to the constant improvement that's integral to growing a subscription business. Your billing platform should have diagnostic capabilities, deep analytics and a wide range of reporting options. This will enable you to track the right KPIs, so you can do each of the following, which fundamentally influence and improve customer experiences:

- Identify customer behavior patterns and segment them to tailor billing experience further

- Take financial positions (e.g: identify revenue leakages and opportunities)

- Create better marketing strategies (e.g: identify promotional returns and analyze campaign outcomes)

Integration with your subscription business

Understanding how intertwined billing is with the rest of the subscription experience means recognising the need for connectivity between internal and external systems. As we have said, billing doesn't sit in isolation, ideologically or practically, from the rest of the customer experience.

As such, it's essential that billing systems do not work alone, but as a core component of your revenue operations tech stack. We are strong advocates of minimizing the number of different systems you operate in order to minimize complexity and margin for error. However, sometimes additional platforms are needed for specific reasons. For that reason, it’s essential that your subscription business platform can integrate seamlessly with relevant systems such as different payment options.

keylight does this seamlessly by being API-first, which means it's optimally flexible, allowing it to connect to other systems simply. It also has pre-built webhooks, so it can send notifications between systems and bridge the information gaps between different platforms.

Read about the reason payment integrations are essential for subscription platforms

Security and compliance

Trust is arguably the most important element in a customer experience, particularly when it comes to personal and financial information. From a practical standpoint your business has to be compliant with laws and legislation around data compilation, storage and protection, so you must have best-in-class security in place to protect your customers and your business.

However, it's also important that your customers can see signs of the measures you're taking to protect them—it means making billing processes easy and simple with the hallmarks of trust at each point. Key messaging and seamless systems are an essential part of putting your customers at ease.

The damage caused to a business when there is a data leak or a customer's information is compromised can be extremely destructive to your business and your reputation. Your subscription system needs to rank well in user-level access and internal security.

Business benefits

A comprehensive billing experience

Having a billing tool to automate invoice generation and bill the customer on a predefined schedule is great, but enabling the customer and internal user experience requires a business platform built with a different DNA.

The key to creating the perfect billing experience in your subscription business is to think of it as part of the customer experience rather than a mere financial function. Understanding that recurring billing and subscription management go hand in hand, and that billing management can have far-reaching consequences across your revenue operations, will make you consider your expectations of your billing platform and processes differently.

Where most people look for a billing tool first and then think about the other capabilities later, the best thing you can do is consider billing in conjunction with how you want to deliver your user experience. Design the process and workflows needed first, then choose the technology that fulfills those gold standard requirements rather than letting the system dictate what's possible. It's also important to choose technology that does not only tick all the boxes today, but that has the capacity to evolve and meet future needs as well.

Placing the customer at the center of your business development and growth plans will help you understand the importance of minimizing friction across the entire customer lifecycle, including the billing experience. With that in mind, by implementing a comprehensive billing platform based on these key criteria, you can help boost monthly recurring revenue, reduce churn rates, and provide a stellar customer experience.

Ensure ongoing success

What the keylight business platform offers

keylight has been designed specifically for subscription businesses, with their performance and long-term sustainability woven into its DNA, providing flexibility and adaptability to optimize business function and user experiences. All the features mentioned in this article are supported and enabled by keylight.

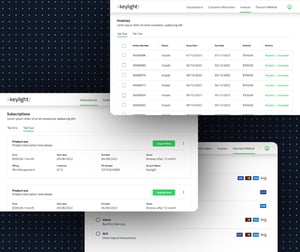

Thanks to core innovations such as a pre-built user interface for any billing and transaction activities, and an extended frontend for customers, partners and internal users, as well as the flexibility to be fully automated, fully manual or part automated and part manual, keylight enables any workflow required for a frictionless commerce to finance experience.

Fundamentally, it's a platform that allows you to achieve whatever you want to achieve with your business, rather than being limited by the technology itself.

If you would like to find out more, we would like to invite you to speak to our team and ask any questions you may have, from billing to the wider user experience.

Power your business

with the right subscription solutions

![]() Book a free consultation

Book a free consultation

Power your business

with the right subscription solutions

![]() Book a free consultation

Book a free consultation

Explore keylight's superior value compared to conventional subscription platforms

![]() Compare now

Compare now

Explore keylight's superior value compared to conventional subscription platforms

![]() Compare now

Compare now